Stocks pulled back from record highs amid pressure across the technology sector after a global tech outage sent shockwaves throughout the market on Friday. The S&P 500 (^GSPC) ended the week down nearly 2% while the Nasdaq Composite (^IXIC) dropped more than 3.5% on the week. Both indexes had their worst weekly performance since April. Meanwhile, the Dow Jones Industrial Average (^DJI) rose about 0.7%.

This week, critical readings on economic growth and inflation, as well as the start of Big Tech earnings, will determine if the malaise continues. On the economic data side, the advanced reading of second quarter economic growth is slated for Thursday, followed by the June reading of the Personal Consumption Expenditures index, the Fed’s preferred inflation gauge, on Friday.

🚨Market Rotation Alert!🚨 T&G Weekly Outlook

Investors cycle out of big tech and into mid-caps 🧢 But what’s driving this shift?🤔Get the inside scoop on inflation, GDP, and earnings this week! 👉 https://t.co/GXuTxkWYjG #Earnings #MarketWatch #MartketAnalyst #MarketData… pic.twitter.com/qnrIy9vePk

— Trades & Gains (@tradesandgains) July 21, 2024

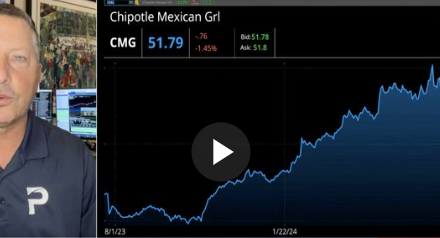

In corporate news, a slew of S&P 500 companies are expected to report quarterly results in a week headlined by Alphabet (GOOGL, GOOG), Tesla (TSLA), and Chipotle (CMG).

Last week, new data showing a slowdown in inflation prompted markets to put the chances that the Federal Reserve cuts rates by the end of its September meeting at 100%.

The week ahead will bring another look at inflation, this time with the Fed’s preferred gauge: The Personal Consumption Expenditures (PCE) index.

Due out on Friday, economists expect “core” PCE increased 2.5% in June from the previous year, down from May’s 2.6% annual gain. Over the prior month, economists expect “core” PCE rose 0.2%, slightly above May’s 0.1% increase.

The release comes less than a week before the Fed’s next monetary policy decision on July 31. Markets are widely expecting the central bank to hold interest rates steady.

One key question on investors’ minds is whether the economy can remain resilient with rates still at their most restrictive levels in more than two decades.

Thursday will bring the first reading of Gross Domestic Product (GDP) for the second quarter. Economists expect the US economy grew at an annualized pace of 1.9% in the second quarter, up from the 1.4% growth rate seen in the first quarter.

🇺🇸 US STOCKS SLUMP AS TECH EARNINGS LOOM; INFLATION, GROWTH DATA IN FOCUS

➡️ Stocks retreated from record highs amid a tech sell-off following a global tech outage.

➡️ The S&P 500 and Nasdaq Composite had their worst weekly performances since April.

➡️ This week, economic data… pic.twitter.com/OnvwSkSp9g

— De Dromedaris (@dedromedaris) July 21, 2024

Bank of America Securities head of economics Michael Gapen summed up expectations for the upcoming week’s data release in a weekly note, writing,” The data should show healthy activity, and that inflation is moving in the right direction.”

Key Points:

- Stocks pulled back from record highs, with S&P 500 and Nasdaq Composite seeing their worst weekly performance since April.

- Focus this week will be on economic growth data and Big Tech earnings from companies like Alphabet, Tesla, and Chipotle.

- The Personal Consumption Expenditures (PCE) index is expected to show a slight decrease in inflation.

- The first reading of the second quarter’s Gross Domestic Product (GDP) is anticipated to reveal a growth rate of 1.9%.

- The Federal Reserve is expected to hold interest rates steady in its upcoming policy decision.

Lap Fu Ip – Reprinted with permission of Whatfinger News