With all of the bad news on Wall Street these days thanks to The Democrats and the Biden Admin policies that have destroyed consumer spending with their forced inflation, there are some bright spots.

Chipotle Mexican Grill (CMG) surpassed market expectations in the latest quarter, even as the restaurant industry faces challenges from cautious consumer spending. The fast-casual chain reported impressive earnings, beating Wall Street forecasts on key metrics such as revenue, earnings per share (EPS), and same-store sales growth.

Chipotle on Wednesday reported quarterly earnings and revenue that topped analysts’ expectations as it saw higher traffic at its restaurants, bucking an industry slowdown. CEO Brian Niccol discusses. https://t.co/xbwP5eNvwy pic.twitter.com/VG57FRvx9w

— CNBC (@CNBC) July 24, 2024

In the second quarter, Chipotle’s revenue surged 18.2% year-over-year to $2.97 billion, edging out the anticipated $2.94 billion. The company’s adjusted EPS came in at $0.34, exceeding the expected $0.32. Same-store sales, a critical indicator of growth, rose by 11.1%, well above the 9.23% projected by analysts. This strong performance builds on a 7% increase in same-store sales reported in the first quarter.

CEO Brian Niccol described the quarter as “outstanding,” attributing success to effective brand marketing and the reintroduction of the popular Chicken al Pastor. The company plans to continue this momentum by reintroducing smoked brisket in the fall, aiming to attract new and returning customers.

Foot traffic at Chipotle locations increased by 8%, surpassing the 6.3% growth forecasted, with gains observed across all income levels. Unlike some competitors who are offering promotional pricing, Niccol stated that Chipotle would not engage in heavy discounting. “We’re focusing on our strengths and not chasing competitors’ tactics,” he emphasized.

Before the earnings release, UBS analyst Dennis Geiger highlighted Chipotle’s strong brand loyalty and value proposition, suggesting the company is well-positioned to sustain its momentum. However, Wedbush analyst Nick Setyan cautioned that value meals from fast-food giants like McDonald’s could pose a challenge, especially as consumers become more price-sensitive.

🌯 “I think this is going to be a tremendous, tremendous report.”#TheMorningTrade ➡️ @cboesib’s options strategy on Chipotle $CMG ahead of Q2 earnings is one that captures upside potential:

— Schwab Network (@SchwabNetwork) July 24, 2024

In an interesting development, there were concerns about portion sizes at Chipotle. Wells Fargo analyst Zachary Fadem conducted a study across eight New York City locations, ordering the same burrito bowl 75 times to assess consistency. Niccol addressed these concerns during the earnings call, reaffirming the company’s commitment to providing generous portions. He noted that 90% of stores were delivering the correct portion sizes, while the remaining 10% were being re-coached to meet the company’s standards.

Despite these challenges, Chipotle’s CFO Jack Hartung highlighted the company’s pricing power, noting that menu prices had increased by 3% year-over-year. However, there are no plans to raise prices further in 2024, as the company monitors inflation and consumer behavior.

Bernstein analyst Danilo Gargiulo, who rates Chipotle as “Outperform” with an $80 price target, suggested that the company could explore new avenues for growth. These include extending operating hours to late night or breakfast, revamping the loyalty program, and capitalizing on the growing influence of Gen Z consumers.

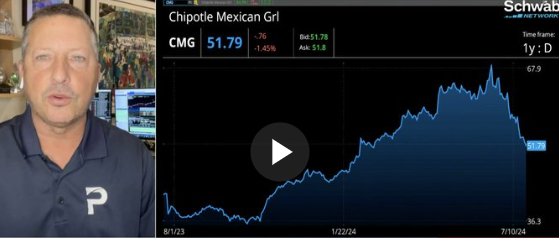

In June, Chipotle executed a 50-for-1 stock split, though shares have dipped nearly 18% over the past month. Nonetheless, following the earnings announcement, shares rose by about 14% in after-hours trading, indicating strong investor confidence.

Shares of #Chipotle rallied after beating Q2 estimates. The company also reported an increase in transaction growth.

Brian Niccol, CEO of @ChipotleTweets, tells @MorganLBrennan what he is seeing in consumer behavior. $CMG pic.twitter.com/5L94b3qwfT

— CNBCOvertime (@CNBCOvertime) July 24, 2024

For Q2 2024, Chipotle’s results included $2.97 billion in revenue versus $2.94 billion expected, and a same-store sales increase of 11.1%, compared to the 9.23% forecast. The company ended the quarter with 3,530 stores, slightly below the projected 3,540, having opened 52 new locations, including 46 with drive-through “Chipotlane” features. Looking ahead, Chipotle plans to open between 285 and 315 new restaurants in 2024, with over 80% featuring the drive-through model, aiming to reach 7,000 locations across North America in the long term.

Major Points:

- Chipotle exceeded expectations in Q2, with revenue reaching $2.97 billion and adjusted EPS of $0.34.

- Same-store sales grew by 11.1%, surpassing forecasts, driven by successful marketing and menu innovations.

- Foot traffic increased by 8%, outperforming expectations across all income groups.

- The company maintained pricing power without resorting to heavy discounts, despite a competitive market.

- Chipotle plans to expand its store count significantly, aiming for 7,000 locations in North America long-term.

Al Santana – Reprinted with permission of Whatfinger News